As a quick note to my Patreon patrons, as of the start of July they will be charging sales tax on assorted, but not all, patron pledges, thanks to new legal requirements. This affects 36 states of the US and assorted foreign parts, in different ways for each, and may only affect certain parts of some pledges, and so forth.

Fuller details are here and will be e-mailed to you by Patreon on the 1st of June; I’m fiddling with settings and descriptions and so forth to minimize the impact to you, so I don’t recommend doing anything precipitate, please. But we’ll have to see how it works out for each individual in the long run.

If you don’t like it, please be assured that I don’t like it either. I can’t imagine that Patreon like it all that much, for that matter. But there’s nothing any of us can do about it, sadly, given “required by law”.

However, if you’d like to rise up in a bloody revolution, tear down the instrumentalities of extortion and oppression, and hang everyone with a favorable opinion of sales tax from the nearest convenient lamp posts, on the other hand, and have a viable plan to do so, do feel free to get in touch.

I’m in a quandary here, because I can see both sides-

The states have been allowing a lot of companies and small businesses to get away with a “wink wink, nudge nudge” on this subject and ultimately for humans, we need a government to handle quite a bit of things. And, unfortunately, we pay for government with taxes, fees, and ulcers.

On the other hand, because governments don’t have the incentives to try and figure out better ways of doing things, there is quite a bit of feather bedding that happens, and quite a few of our current governments aren’t even competently corrupt. (I.e. New York in the Tammany Hall era might have been a hotbed of payoffs and kickbacks, but they did get a working sewer system that is still able to handle most of New York’s needs today. Compare to the California Train To Nowhere, which is over budget, has been very slow to build, and is the Platonic ideal of good idea, terrible implementation. Some of the issues are land issues, ways issues, environmental issues, etc, etc, etc…but quite a bit of it is payoffs.)

And, finally, on the gripping hand, the Wuhan Flu/COVID-19 has eaten a lot of the usual sources of revenues for governments. Fewer people driving, using public transit, buying things in stores, etc, etc, etc, and somebody still has to pay the freight. And we still haven’t seen all the consequences of Stay-In-Place yet.

The Teal Deer version? Not surprised, expected it a while ago, hopefully our state governments will try their best to not overreach. But, I live in the People’s Republic of California and I am convinced that Gavin Newsom and the E!Democratic Party here couldn’t find their own butts with maps, a compass, and a WO5 calling the ball-let alone competently run a state.

I am going to have to adjust some of my Patreons at this point, mostly because at least one or two of them have gone full Ugly Political and the cringe is high. I like their stuff, but I would rather keep the relationship at a bit more of an arm’s reach.

Even assuming that first arguendo, the trouble here is that the sales tax is in the running to be the evilest of all taxes. Because it’s regressive.

There is some stunning hypocrisy going on in that the same people who are all gung-ho about how tax breaks and relief should be targeted at the poor, because they spend a greater percentage of their income - often up to all of it - tend to have no problem advocating for higher sales taxes, which by the exact same reasoning preferentially target lower income bands.

But because of their regressiveness - and regardless of whether you consider taxes an unnecessary evil, a necessary evil, or are just wrong - choosing sales taxes requires a special extra level of puppy-kicking mean-spiritedness.

Yes, very much so indeed.

But, you don’t need logic to be a politician. You just need to be convincing and look good on stage, for the most part.

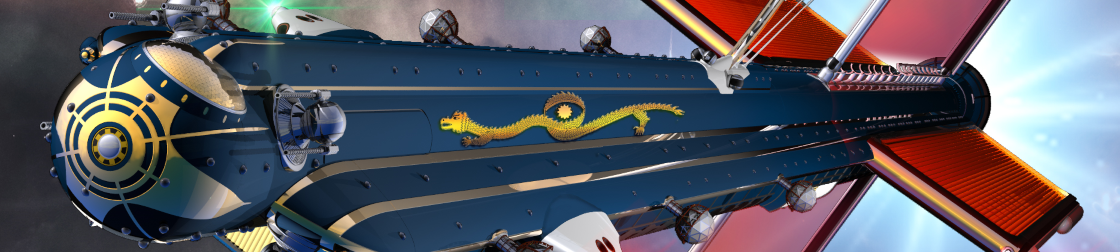

(Which explains why the Empire of the Star has so few politicians. Because too many people there can actually think.)

I would rather we started out with a clean slate, use all the knowledge we’ve gained to build a better tax code. Overall taxes are lower, but more people are paying because there are so many fewer loop-holes and hidden exemptions. And, since there are fewer things to game, we have to have fewer people keeping track of all of these things.

(Personal preference? Flat income tax (to include corporate income, welfare/SSI but not retirement, and investment profits) outside of a declared war, no more than 10%, only exemptions/deductions are catastrophic medical, personal disaster, and/or income directly spent in the care and raising of children. And, only catastrophic medical can get you money back from the Government. A declared war lets you get away with a graduated income tax, but there can’t be more than a 5% increase between tiers, no more than six tiers, and going up a tier requires you to have an income of at least 100% more than the start of the previous tier. Must be passed by both houses of Congress with a 2/3rds vote, after the declaration of war, and continuance must be the first thing voted on when a session of Congress begins. And, it has to get a 2/3rds vote, with a +1 vote on each side (i.e. 287 votes in the House, 66 in the Senate. Assuming a perfect 2/3rds proportion, the next session of Congress every year has to vote to continue with 288 House votes and 67 Senate votes). If the bill doesn’t pass, it ends immediately and a new bill has to be passed.

(Oh, and it’s Constitutional requirement. I’d like to include a “have to pay sixty days before Congressional/Presidental elections in cash,” but that might be a bridge too far.)

Issues I can see:

Constitution-Writer: “Enh, surely no-one would find a way to declare perpetual war to keep progressive taxation in place?”

Congress (thumbing through a copy of Honorverse #10): “Hold our beer!”

Supreme Court: “…sure, why not.”

People: “Oh, for fuck’s sake!”

Wars should be funded through war bonds, as this is both voluntary and provides a healthy check on politicians’ urges to write their name in the history books using other peoples’ blood.